Amazon vs. Temu: Warum beide ihr Modell jetzt kopieren

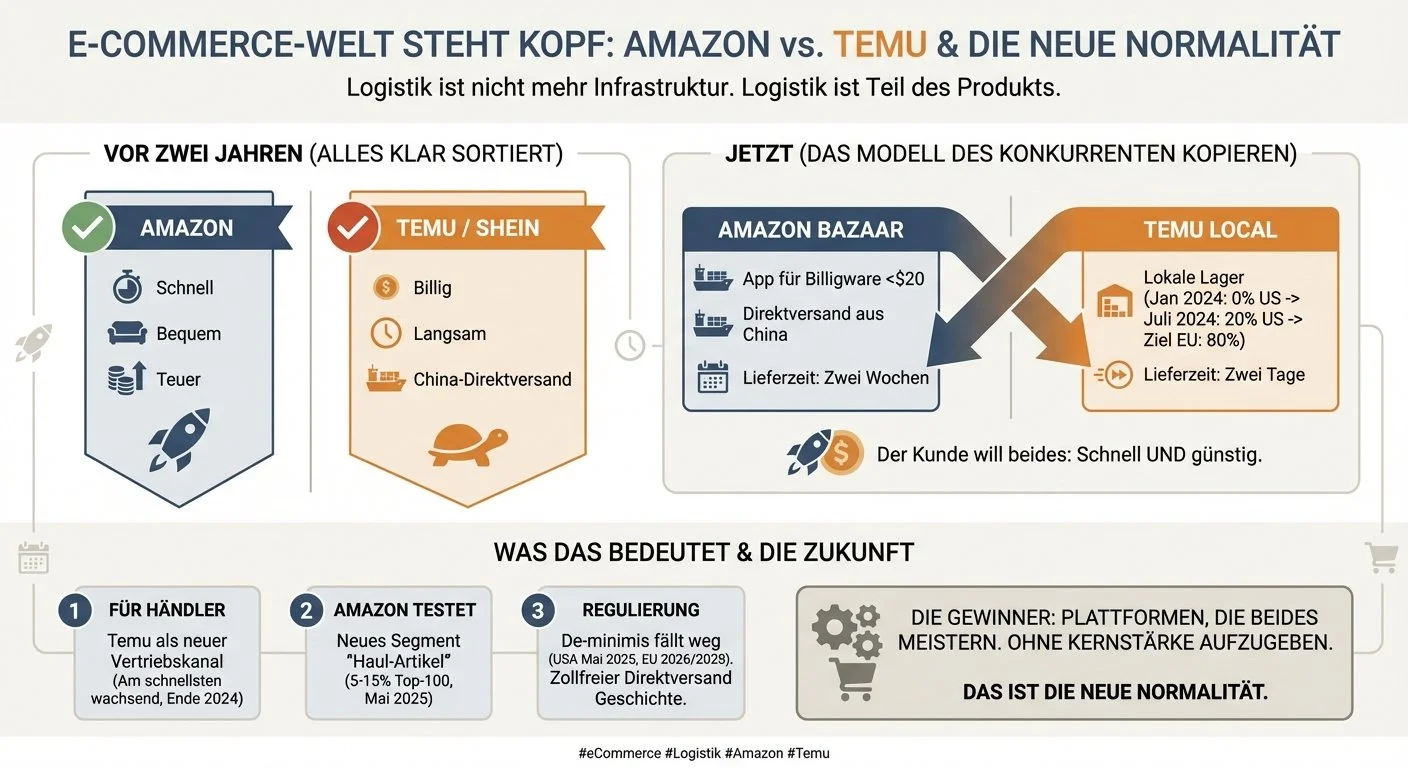

Noch vor zwei Jahren war die E-Commerce-Logistik klar geteilt. Amazon hatte über Jahrzehnte und Milliarden ein inländisches Fulfillment-Netzwerk aufgebaut, das Geschwindigkeit und Convenience zum Standard machte. Temu und Shein setzten dagegen auf ein radikal anderes Modell: Direktversand aus chinesischen Fabriken, wobei sie die De-minimis-Zollbefreiung ($800 in den USA, €150 in der EU) nutzten, um Zollkosten zu umgehen und Preise zu drücken.

Diese Trennung löst sich jetzt auf. Beide Seiten bewegen sich auf das Modell der Konkurrenz zu – nicht, weil sie ihre Kernstärke aufgeben wollen, sondern weil sie erkennen, dass moderner E-Commerce beides erfordert.

Temus Transformation: Vom Wochenwarten zum Zwei-Tage-Versand

Die Zahlen sind bemerkenswert: Im Januar 2024 kam kein einziger US-Verkauf von Temu aus lokalen Lagern. Im Juli 2024 waren es bereits 20%. Die Ziele sind aggressiv: 50% local-to-local im UK bis Ende 2025, 80% in Europa über lokale Lager.

Das bedeutet konkret: Manche Temu-Bestellungen kommen jetzt innerhalb von zwei Tagen an – ein Quantensprung gegenüber den wochenlangen Wartezeiten, die das frühe Temu-Erlebnis definierten.

Strategisch interessant ist der Asset-Light-Ansatz: Temu baut kein eigenes Lagernetzwerk auf, sondern arbeitet mit Fulfillment-Providern wie WINIT und Easy Export. In der Türkei testet Temu ein Einladungsprogramm für lokale Verkäufer mit Next-Day-Delivery.

Amazons Antwort: Haul und Bazaar

Amazon geht den umgekehrten Weg. Amazon launchte Bazaar - eine Standalone-App, die das Haul-Erlebnis (meist Direct-from-China) auf 14 weitere Länder ausweitet. Zusammen mit den bestehenden Haul-Märkten ist Amazons Low-Price/Slow-Shipping-Modell jetzt in über 25 Märkten präsent.

Die Mechanik: Direktversand aus chinesischen Lagern, Artikel unter $20, Lieferung in zwei Wochen oder weniger.

Die globale Bazaar-Expansion signalisiert: Dies ist kein Experiment, das Amazon aufgeben wird.

Der regulatorische Treiber: Das Ende der De-minimis-Ära

Der Katalysator für diese Konvergenz ist regulatorischer Natur. Die USA setzten ihre $800-De-minimis-Schwelle für chinesische Importe im Mai 2025 aus. Temu und Shein mussten daraufhin Preise erhöhen und Operationen umstrukturieren.

Die EU folgt: Die Abschaffung der €150-Zollbefreiung wurde beschlossen. Ein Interim-Framework kommt 2026, die vollständige Eliminierung 2028 mit dem Launch des EU Customs Data Hub.

Ohne zollfreien Direktversand müssen Plattformen andere überzeugende Gründe bieten, um aus dem Ausland zu versenden – und genau das treibt die Zwei-Tier-Strategie.

Das Ergebnis: Zwei-Tier-Sortimentsstrategien

Die Konvergenz führt zu einem neuen Betriebsmodell:

Temu und Shein halten Direct-from-China für preissensitive Produkte aufrecht, fügen aber lokales Fulfillment für Geschwindigkeit und erweiterte Kategorien hinzu.

Amazon behält FBA als Rückgrat, testet aber Direct-from-China über Haul/Bazaar für Ultra-Low-Price-Waren.

TikTok Shop - dessen Sales primär durch Content getrieben werden, nicht durch Logistik - erkennt dennoch, dass Fulfillment-Geschwindigkeit für nachhaltiges Wachstum entscheidend ist.

Die Kernbotschaft

Keine Seite gibt ihr Kernmodell auf. Amazon bleibt bei Prime, Temu verlässt Direct-from-China nicht. Aber beide erkennen, dass E-Commerce nicht mehr eindimensional ist.

Die entscheidende Einsicht: Logistik ist genauso Teil des Produkts wie das Produkt selbst.

Die Gewinner werden jene Plattformen sein, die „fast-and-convenient" und „cheap-but-slower" gleichzeitig meistern - ohne das zu opfern, was sie ursprünglich erfolgreich gemacht hat.